Understanding Stock Incentive Plans in Corporate Settings

Stock incentive plans are a critical component of compensation strategies used by corporations to motivate and retain employees. These plans typically involve granting company stock or stockbased instruments to employees as part of their overall compensation package. Let's explore the key aspects and benefits of stock incentive plans.

Types of Stock Incentive Plans

1.

Stock Options

:

Overview

: Stock options grant employees the right to purchase company stock at a predetermined price (exercise price) within a specified period.

Types

:

Incentive Stock Options (ISOs)

: Offered to key employees and provide potential tax advantages if certain conditions are met.

NonQualified Stock Options (NSOs)

: More common and flexible, but typically subject to ordinary income tax upon exercise.

2.

Restricted Stock Units (RSUs)

:

Overview

: RSUs are units representing company stock that are granted to employees but come with restrictions (e.g., vesting conditions).

Vesting

: RSUs often vest over a specified period, tying the employee's ownership to their continued service with the company.

3.

Stock Appreciation Rights (SARs)

:

Overview

: SARs provide employees with a cash or stock payout based on the increase in the company's stock price over a predetermined period.

No Ownership Requirement

: Unlike stock options or RSUs, SARs do not require employees to purchase shares to receive the benefit.

Objectives of Stock Incentive Plans

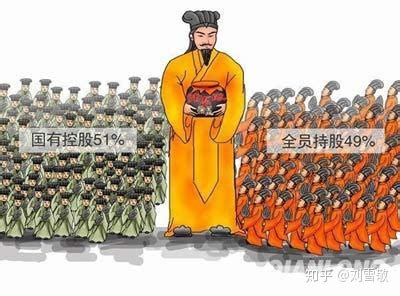

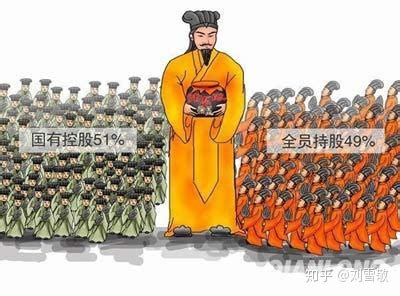

Align Interests

: Stock incentives align employee interests with shareholders by making employees partial owners of the company.

Retain Talent

: Stock grants often have vesting schedules that encourage employees to stay with the company to realize the full benefit.

Motivate Performance

: Employees are motivated to contribute to the company's success, as their compensation is tied to the company's performance and stock price.

Benefits for Employees

Potential for Growth

: Employees can benefit from the company's success through stock price appreciation.

Retention Incentive

: Vesting schedules encourage longterm commitment and loyalty.

Tax Advantages

: Depending on the plan and jurisdiction, there may be tax advantages associated with certain stock incentive types.

Considerations for Employers

Costs

: Issuing stock or stockbased instruments dilutes existing shareholders' ownership and may impact financials.

Complexity

: Stock incentive plans require careful structuring to balance employee motivation with shareholder interests.

Legal and Tax Implications

: Plans must comply with regulatory requirements and tax laws.

Designing an Effective Stock Incentive Plan

1.

Clear Objectives

: Define what the company aims to achieve through the plan (e.g., retention, performance).

2.

Tailored Structure

: Choose the right type of plan based on company stage, industry norms, and employee demographics.

3.

Communicate Clearly

: Transparent communication about the plan's terms, risks, and benefits is crucial for employee buyin.

4.

Regular Review

: Regularly assess and adjust the plan to ensure it remains effective and aligned with business goals.

Conclusion

Stock incentive plans are powerful tools for attracting, retaining, and motivating talent in corporations. By granting employees ownership in the company, these plans align interests and encourage employees to contribute to longterm success. However, designing and implementing effective stock incentive plans requires careful consideration of legal, financial, and strategic factors to maximize their benefits for both employees and employers.